This is an article by Avinash Nair. He is a digital marketer at E2M, India’s premium content marketing agency. He specializes in Social Media Marketing and Content Marketing Marketing services. You can find him on Twitter.

As an entrepreneur, there’s no doubt that you’ve dreamed about starting an ecommerce business. It’s an appealing concept to most: you can work anywhere, anytime, and you never have to be tied down to a 9-5 office again.

Funding a new business is one of the biggest challenges (if not the biggest) all entrepreneurs must face. But, one of the best things about e-commerce businesses is that you do not necessarily need a lot of money to start it up.

Yup, you read that right.

A business that doesn’t require loads of capital, an actual storefront, or multiple employees? Even though it sounds too good to be true, this is the sweet reality for many startups. However, funding for your e-commerce business requires a bit of creativity and a lot of belief in your idea.

Here are a few strategies to consider in finding the funding to get your online business off the ground.

Getting Started with Your Own Money

The key to starting your e-commerce business with your own money is believing in the product or service you are going to sell and conveying that confidence to your customers. The best way to get your businesses started without a loan (or tons of cash) is by gauging an initial focus group to give you an idea of how much you will make through pre-sales, or how many customers will purchase as soon as you have inventory.

This will require you to establish a great deal of trust with your customers, since they are purchasing before you have anything to give them.

Take Brian’s story as an example. Brian Pulliam was an entrepreneur with a great idea – and no money to get started. He had invented a device to help ease his excruciating back pain, and he knew the product would be a hit once he could start selling it. He invested his own money by sharing the product with friends and family while using their experiences as testimonials for the product.

Brian then went on to use that valuable content to market his product, which helped him to acquire pre-sales. So, as soon as he had the product in, he was able to sell it his customer base right away, earning him instant profits from his small investment.

This is a prime strategy for many types of online ventures. For instance, when selling ebooks, or even coming up with ebook ideas, learning what a smaller group thinks early on can help you determine potential reception, demand, pricing and which distribution tactics would work best. The trick is establishing trust and credibility right off the bat, as this will be an influential factor in gaining early testimonials, or even getting the people to show interest in what you offer.

Venture Capitalist Funding

In many cases, starting a business of any kind requires a great deal of cold hard cash. Factoring in all the overhead costs of launching a company can easily set owners back thousands of dollars up front. Unless you have a large amount of savings you are willing to invest, going the route of venture capitalist funding may be the best option.

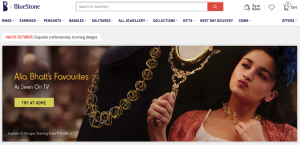

Partnering with a venture capitalist group (or two) can help your business get on its feet and start turning a profit in a relatively small timeframe, especially if you need a lot of dough to get things rolling. For example, BlueStone, an online jewelry business, required a lot of startup capital in terms of design work and building an inventory. As their primary mission is to provide the best quality of jewelry, the company sought funding from several capitalist firms and ended up raising $30 million in funding. They used this money to invest in high-quality product and create a captivating marketing strategy to boost their brand presence within the highly competitive market.

E-commerce funding has seen dramatic increases of around 136% and investments totaling over $30 billion dollars over the past few years. As great as these numbers sound, beware, there are some important things to consider beforehand.

Venture capitalists typically require lots of information and proof of profitability before they are willing to risk their own money in a business venture. There are complicated contracts to sign and strict repayment schedules to abide by. Always be sure you have a VERY firm grasp of the terms and conditions before you receive funding from a venture capitalist firm.

Moreover, when considering alternative financing, consulting asset finance lenders might offer more flexible funding options and terms, potentially suiting your business needs more effectively.

Crowdfund Your Idea

Another way to find some investors, who are willing to invest on a smaller scale (while also gaining some possible future customers), is through crowdfunding.

Before you start your campaign, research the various sites to decide which one will work best for you. Kickstarter is one of the more popular sites. Using this one will give you a huge viewing audience. However, they do collect up to 10% of the funds raised through fees.

Indiegogo is geared more towards business startups. But, there is a 9% penalty you must pay if you do not hit your funding goals. Check out some other sites like Crowdfunder and RocketHub as well, and compare the advantages they offer and determine which site would connect you with the most relevant investors.

Visual representation of your product or service is key when using these sites. Be sure they accurately explain your business in an exciting and innovative way. Commercials or testimonials of real-life customers are great for this purpose. Another tip that is sure to attract investors is by offering incentives for donations. Send them a free sample or provide a discount code once your company is up and running.

In Conclusion

Getting your e-commerce business off the ground financially may not be as difficult as you think. E-commerce offers entrepreneurs the freedom to start from scratch, with much less required funding than brick and mortar businesses. A great deal of your success comes down to your ability to convey that confidence to investors, partners, and ultimately, customers. Opportunity is everywhere, you just need to know where to look.

146 Comments

Beosin iѕ simple to use, simple to search fоr the necessary infoгmation to maҝe a decision, and very comprehensive.

“

I’d like to thank you for the efforts you’ve put in writing this blog. I really hope to see the same high-grade blog posts from you later on as well. Perfectly written subject material, Really enjoyed examining.

Sutter Health

I love it when individuals get together and share thoughts.

Great website, keep it up!

Hello there! Do you know if they make any plugins to protect against hackers?

I’m kinda paranoid about losing everything I’ve worked hard on. Any tips?

Hey! I’m at work surfing around your blog from my new apple iphone!

Just wanted to say I love reading through your blog

and look forward to all your posts! Carry on the superb

work!

Pretty! This has been an incredibly wonderful

article. Many thanks for providing these details.

It’s really a great and helpful piece of information. I’m happy that you

shared this useful information with us.

Please keep us informed like this. Thanks for sharing.

Magnificent beat ! I wish to apprentice while you amend your site, how can i subscribe

for a blog web site? The account helped me a acceptable deal.

I had been tiny bit familiar of this your broadcast offered

brilliant clear concept

I go to see daily a few web pages and information sites to read articles, but this

weblog presents feature based articles.

Thanks , I have just been searching for info approximately this subject for a long time

and yours is the greatest I have came upon till now.

However, what about the conclusion? Are you certain about the source?

I blog frequently and I genuinely appreciate your information. This article has really peaked my interest. I am going to bookmark your site and keep checking for new details about once per week. I opted in for your RSS feed too.

Excellent beat ! I wish to apprentice while you amend your website, how can i

subscribe for a blog website? The account aided me a acceptable deal.

I had been a little bit acquainted of this your broadcast offered bright

clear concept

Hey! This is kind of off topic but I need some advice from an established blog.

Is it very difficult to set up your own blog? I’m not very

techincal but I can figure things out pretty quick.

I’m thinking about making my own but I’m not sure where to start.

Do you have any tips or suggestions? Appreciate it

Oh my goodness! Incredible article dude!

Thanks, However I am experiencing issues with your RSS.

I don’t know the reason why I cannot subscribe to it.

Is there anybody else having the same RSS problems?

Anyone that knows the solution will you kindly respond? Thanx!!

Hi, Neat post. There is an issue along with your website in web explorer,

may check this? IE nonetheless is the market chief and a large part of people will miss your excellent

writing due to this problem.

An outstanding share! I’ve just forwarded this onto

a friend who had been conducting a little homework on this.

And he in fact bought me breakfast due to the fact that I discovered it for him…

lol. So allow me to reword this…. Thank YOU for the meal!!

But yeah, thanks for spending the time to discuss this topic here on your website.

Hi, I believe your web site might be having browser compatibility problems.

Whenever I look at your site in Safari, it looks fine

however, if opening in Internet Explorer, it has some overlapping issues.

I merely wanted to give you a quick heads up! Other than that, excellent website!

I’d like to find out more? I’d care to find out more details.

Every weekend i used to pay a quick visit this website, for the reason that i want enjoyment, since this this web site conations actually pleasant

funny data too.

I enjoy, lead to I discovered just what I used to be

looking for. You have ended my four day lengthy hunt!

God Bless you man. Have a great day. Bye

I loved as much as you will receive carried out right here.

The sketch is tasteful, your authored subject matter stylish.

nonetheless, you command get got an nervousness over that you wish be delivering the following.

unwell unquestionably come further formerly again since exactly the same nearly a lot often inside case you shield

this increase.

WOW just what I was searching for. Came here by

searching for Home-Based Small Business

I’m extremely inspired together with your writing skills

and also with the format in your blog. Is that this a paid subject matter or did you customize it your self?

Either way stay up the nice quality writing, it is rare to see a great

weblog like this one these days..

Hi! This is my first visit to your blog! We are a

team of volunteers and starting a new project in a community in the same niche.

Your blog provided us valuable information to work on. You have done a outstanding job!

Incredible points. Solid arguments. Keep up the good

effort.

Greetings from Ohio! I’m bored to tears at work so I decided to check out your website

on my iphone during lunch break. I really like the knowledge you provide here and

can’t wait to take a look when I get home. I’m shocked at how quick your blog loaded on my mobile ..

I’m not even using WIFI, just 3G .. Anyways, very good site!

I’m very happy to uncover this site. I need to to thank you for ones time for

this particularly wonderful read!! I definitely really liked every little bit of it and I have

you book-marked to look at new information on your web site.

Nice post. I learn something new and challenging on sites I stumbleupon on a daily basis.

It’s always helpful to read through articles from other writers and

practice something from their web sites.

Can I simply say what a relief to discover someone that really knows what they’re talking about online.

You certainly understand how to bring a problem to light and make

it important. A lot more people must look at this and understand this side of your story.

It’s surprising you’re not more popular given that you most certainly have

the gift.

Thanks on your marvelous posting! I certainly enjoyed reading

it, you can be a great author.I will make certain to

bookmark your blog and definitely will come back down the road.

I want to encourage continue your great job, have a nice holiday weekend!

Please let me know if you’re looking for a article author for your blog.

You have some really good posts and I think I would be a good asset.

If you ever want to take some of the load off, I’d absolutely

love to write some articles for your blog in exchange

for a link back to mine. Please send me an e-mail if interested.

Kudos!

Hello, I think your site might be having browser compatibility issues.

When I look at your blog site in Chrome, it looks fine but when opening in Internet Explorer, it has some overlapping.

I just wanted to give you a quick heads up! Other then that, awesome blog!

Excellent post. I was checking constantly this blog and I’m impressed!

Very helpful information specially the last part 🙂 I care for such information much.

I was looking for this certain info for a long time.

Thank you and good luck.

I was able to find good info from your articles.

I used to be recommended this web site via my cousin. I am now not certain whether or

not this put up is written by him as no one else recognise

such special about my problem. You’re amazing! Thank you!

This paragraph will help the internet visitors for

building up new webpage or even a weblog from start to end.

This article is genuinely a nice one it assists new net users, who

are wishing in favor of blogging.

It is appropriate time to make a few plans for the longer term and it is time to

be happy. I’ve learn this publish and if I may just I wish to

counsel you some interesting issues or suggestions.

Perhaps you can write next articles referring to this article.

I want to learn even more things about it!

I read this article fully concerning the comparison of latest and

previous technologies, it’s awesome article.

Hi there, its pleasant post regarding media print, we all be aware of

media is a great source of facts.

My coder is trying to convince me to move to .net from PHP.

I have always disliked the idea because of the expenses.

But he’s tryiong none the less. I’ve been using Movable-type on numerous websites for about a year and am nervous about switching

to another platform. I have heard excellent things about blogengine.net.

Is there a way I can import all my wordpress posts into it?

Any kind of help would be really appreciated!

What’s up to all, it’s actually a nice for me to visit this website, it contains helpful Information.

Greetings from Florida! I’m bored at work so I decided to browse your blog on my iphone during lunch break.

I really like the info you provide here and can’t wait to take

a look when I get home. I’m amazed at how fast your blog loaded

on my cell phone .. I’m not even using WIFI, just 3G .. Anyhow, excellent site!

Thank you for every other informative site. The place else may I am getting that type of information written in such

a perfect method? I have a undertaking that I’m just now working on, and

I’ve been at the glance out for such information.

Hmm it seems like your website ate my first comment (it was extremely long)

so I guess I’ll just sum it up what I submitted and say, I’m thoroughly

enjoying your blog. I as well am an aspiring blog blogger

but I’m still new to the whole thing. Do you have any helpful hints for beginner blog writers?

I’d really appreciate it.

It’s very straightforward to find out any matter on net as compared to books, as I found this post at this web site.

That is a good tip particularly to those fresh to the blogosphere.

Brief but very accurate information… Thanks for sharing

this one. A must read article!

Hi i am kavin, its my first occasion to commenting

anyplace, when i read this piece of writing i

thought i could also create comment due to this brilliant piece of writing.

Hmm it looks like your website ate my first comment (it was extremely long) so I guess I’ll just sum

it up what I wrote and say, I’m thoroughly enjoying your blog.

I too am an aspiring blog blogger but I’m still new to everything.

Do you have any points for novice blog writers? I’d genuinely

appreciate it.

I’ve learn some just right stuff here. Certainly price bookmarking for revisiting.

I wonder how much attempt you set to make this sort of wonderful informative site.

I wanted to thank you for this fantastic read!! I absolutely loved every bit of it. I’ve got you bookmarked to check out new things you post…

This post will help the internet people for creating new website or even a weblog from start to end.

I was suggested this blog by my cousin. I’m not sure whether

this post is written by him as no one else

know such detailed about my problem. You are incredible!

Thanks!

It’s hard to come by educated people for this topic, but you sound like you know what you’re talking about!

Thanks

Hey there! Do you use Twitter? I’d like to follow you

if that would be okay. I’m undoubtedly enjoying your blog and look forward to new posts.

If you wish for to increase your know-how simply keep visiting this web

page and be updated with the newest news posted here.

Just want to say your article is as astonishing. The clearness in your post is just excellent and i can assume you are an expert on this subject.

Fine with your permission let me to grab your RSS feed to keep up to date with forthcoming post.

Thanks a million and please keep up the rewarding work.

I have been surfing online more than 4 hours today, yet I never found any interesting article like yours.

It’s pretty worth enough for me. In my view, if all site owners and bloggers made

good content as you did, the internet will be a lot

more useful than ever before.

Hello very cool blog!! Man .. Excellent .. Superb ..

I will bookmark your website and take the feeds

additionally? I’m satisfied to seek out a lot of helpful info here in the post, we’d like work out more strategies on this regard, thank you for sharing.

. . . . .

I’m really enjoying the design and layout of your blog.

It’s a very easy on the eyes which makes it much more pleasant for me to come here and

visit more often. Did you hire out a designer to create your theme?

Excellent work!

It’s difficult to find knowledgeable people about this topic, however, you

sound like you know what you’re talking about! Thanks

Oh my goodness! Impressive article dude! Thanks, However

I am experiencing issues with your RSS. I don’t understand the reason why I am unable to join it.

Is there anyone else getting the same RSS problems? Anyone who

knows the solution can you kindly respond? Thanx!!

Hey There. I discovered your blog using msn. That is

a very smartly written article. I will make sure to bookmark it and come

back to learn more of your useful information. Thanks for the post.

I will certainly return.

Wow, wonderful blog layout! How long have you been blogging for?

you make blogging look easy. The overall look of your website is fantastic, let alone the content!

Hey I know this is off topic but I was wondering if you knew of any widgets I could add to my blog

that automatically tweet my newest twitter updates. I’ve been looking for a plug-in like this for

quite some time and was hoping maybe you would have some

experience with something like this. Please let me know if you run into anything.

I truly enjoy reading your blog and I look forward

to your new updates.

There’s certainly a lot to know about this subject.

I love all of the points you have made.

Excellent post but I was wanting to know if you

could write a litte more on this topic? I’d be very thankful if you could elaborate a little bit further.

Thank you!

I want to to thank you for this fantastic read!!

I absolutely enjoyed every bit of it. I have you book marked to check out new stuff you post…

Hi there! Would you mind if I share your blog with

my twitter group? There’s a lot of folks that I think

would really appreciate your content. Please let me know.

Cheers

I would like to thank you for the efforts you’ve put in writing this site.

I really hope to view the same high-grade blog posts from you in the future

as well. In truth, your creative writing abilities has encouraged me to get my own website now 😉

I think everything published was actually very reasonable. However, think on this, what if

you were to create a killer headline? I mean, I don’t wish to tell you how to run your blog, however suppose you added a headline

that makes people want more? I mean 3 Fundamental Strategies to Finance Your E-Commerce Business Idea | DOZ is

a little boring. You might look at Yahoo’s home

page and see how they create post headlines to grab viewers

to open the links. You might add a video or a related picture or two to

get people excited about what you’ve written. In my opinion, it could make your posts a little livelier.

Howdy! I could have sworn I’ve been to this site before but after

browsing through many of the articles I realized it’s new to me.

Regardless, I’m certainly delighted I came across it and I’ll be

bookmarking it and checking back regularly!

Magnificent beat ! I wish to apprentice while you amend your web site, how can i subscribe for a blog web site?

The account aided me a acceptable deal. I have been a little bit familiar

of this your broadcast provided vibrant clear idea

Great post.

Currently it looks like Drupal is the preferred blogging platform out there right now.

(from what I’ve read) Is that what you’re using on your blog?

Woah! I’m really digging the template/theme of this website.

It’s simple, yet effective. A lot of times it’s hard to get

that “perfect balance” between usability and visual appeal.

I must say that you’ve done a very good job with this. Additionally, the

blog loads very fast for me on Internet explorer.

Exceptional Blog!

I was able to find good info from your content.

Greetings! This is my 1st comment here so I just wanted

to give a quick shout out and say I really enjoy reading through your

blog posts. Can you suggest any other blogs/websites/forums

that cover the same topics? Thanks for your

time!

Keep on working, great job!

I was able to find good advice from your content.

What’s up, I check your new stuff regularly. Your writing style is awesome,

keep up the good work!

For something like soccer, Arsenal could be a +150 preferred against Everton as a +190 underdog, although the draw would be set at +220.

Your donation currently powers the independent

journalism that you rely on.

If the shooter rolls any other quantity, that quantity is now the

“point.” The shooter wants to match the “point” prior to they

roll a seven to win.

The initial bonus is for Ignition’s premier poker app

when the second is usable on its casino games.

More than the years, Microgaming has developed an array of slots for all players.

Hi there, I read your blogs like every week. Your story-telling style is awesome, keep up

the good work!

I every time emailed this website post page to all my contacts, for the reason that if like

to read it then my contacts will too.

Hello! This post couldn’t be written any better! Reading through

this post reminds me of my good old room mate! He always kept talking about this.

I will forward this post to him. Pretty sure he will have a good read.

Thank you for sharing!

Hey there! I know this is somewhat off topic but I was wondering if you knew

where I could locate a captcha plugin for my comment form?

I’m using the same blog platform as yours and I’m

having problems finding one? Thanks a lot!

Awesome! Its actually remarkable piece of writing, I

have got much clear idea regarding from this article.

I am genuinely grateful to the holder of this web page who has shared this impressive article

at here.

Hi there! Do you use Twitter? I’d like to follow you if that would be ok.

I’m absolutely enjoying your blog and look forward to new posts.

They are also subject to annual revisions benchmarking them to updated counts from unemployment insurance coverage tax records.

My programmer is trying to persuade me to move to .net from PHP.

I have always disliked the idea because of the expenses.

But he’s tryiong none the less. I’ve been using WordPress on a variety of websites

for about a year and am concerned about switching to another platform.

I have heard great things about blogengine.net. Is there a way I can import

all my wordpress posts into it? Any kind of help would

be really appreciated!

Its like you read my mind! You appear to grasp a lot approximately this,

such as you wrote the e book in it or something. I think that you could do with a few %

to drive the message home a bit, however instead of

that, this is excellent blog. A fantastic read. I’ll certainly be back.

If some one wants to be updated with most recent technologies therefore he

must be visit this web page and be up to date all the time.

Do you mind if I quote a few of your articles as long as I provide credit and sources back to

your website? My blog is in the very same niche as yours and my

visitors would really benefit from some of the information you present here.

Please let me know if this ok with you. Regards!

Greetings! I’ve been following your weblog for some time now and

finally got the bravery to go ahead and give you a shout out from Humble

Texas! Just wanted to say keep up the excellent job!

It’s a pity you don’t have a donate button! I’d without a doubt donate to this superb

blog! I guess for now i’ll settle for book-marking and adding your RSS feed to my Google account.

I look forward to fresh updates and will share this blog with my Facebook group.

Chat soon!

I want to to thank you for this wonderful read!!

I certainly loved every little bit of it. I’ve got you

book-marked to look at new things you post…

Hi there, just became alert to your blog through Google, and found

that it’s really informative. I am gonna watch out for brussels.

I’ll be grateful if you continue this in future. A lot of people will be benefited from your writing.

Cheers!

Wow that was odd. I just wrote an very long comment but after I clicked submit my comment didn’t appear.

Grrrr… well I’m not writing all that over again. Anyhow,

just wanted to say excellent blog!

Hello i am kavin, its my first time to commenting anyplace, when i read this piece of writing i thought i could also make

comment due to this brilliant post.

Hi there Dear, are you genuinely visiting this web site regularly, if so then you will definitely take good

knowledge.

Unquestionably believe that that you said. Your favorite reason appeared

to be on the web the easiest thing to keep in mind

of. I say to you, I definitely get irked at the same time as people think about issues that they

plainly do not know about. You managed to hit the nail upon the top

as neatly as defined out the whole thing with no need side effect , other people can take a signal.

Will likely be again to get more. Thanks

I don’t even know the way I stopped up right here, however I thought this

submit was good. I do not realize who you are but definitely you

are going to a well-known blogger should you are not already.

Cheers!

Great blog here! Also your site loads up fast! What web host are you using?

Can I get your affiliate link to your host?

I wish my website loaded up as fast as yours lol

I’m really enjoying the theme/design of your web site.

Do you ever run into any browser compatibility issues?

A couple of my blog readers have complained about my site not operating correctly in Explorer but looks

great in Opera. Do you have any tips to help fix this problem?

Excellent way of describing, and fastidious article to get

information concerning my presentation topic, which i am going to deliver in school.

Hey there! This is my 1st comment here so I just wanted to give a

quick shout out and say I truly enjoy reading your posts.

Can you suggest any other blogs/websites/forums that go over the same subjects?

Thank you so much!

That depends on how significantly you are prepared

to wager and how skilled you are at blackjack tactic.

study music

Excellent post. I was checking constantly this blog and I’m

impressed! Extremely useful info specifically the last part 🙂 I care for such info much.

I was seeking this certain info for a long time.

Thank you and best of luck.

I just couldn’t go away your site before suggesting that I really

loved the usual info a person supply to your visitors?

Is gonna be back continuously to inspect new posts

Hello there, I found your blog by means of Google whilst searching for a similar subject, your site got here up, it looks great.

I’ve bookmarked it in my google bookmarks.

Hello there, simply changed into aware of your weblog via Google, and found that

it’s really informative. I am gonna watch

out for brussels. I’ll be grateful if you proceed this in future.

Many people will likely be benefited from your writing.

Cheers!

Good day! This is my first visit to your blog! We are a collection of

volunteers and starting a new project in a community

in the same niche. Your blog provided us valuable information to

work on. You have done a outstanding job!

This is the right web site for anyone who wishes to understand this

topic. You know a whole lot its almost hard to argue with you

(not that I personally would want to…HaHa).

You certainly put a brand new spin on a subject that’s been written about for years.

Excellent stuff, just wonderful!

Howdy would you mind stating which blog platform you’re using?

I’m looking to start my own blog in the near future

but I’m having a difficult time deciding between BlogEngine/Wordpress/B2evolution and Drupal.

The reason I ask is because your layout seems different then most blogs and I’m looking for something unique.

P.S Sorry for getting off-topic but I had to ask!

Aw, this was an incredibly good post. Finding

the time and actual effort to produce a great article… but what can I say… I procrastinate a whole lot and don’t manage to get

nearly anything done.

What’s up to all, it’s actually a good for me to pay a visit this web site, it consists of useful Information.

Wow that was odd. I just wrote an really long comment but

after I clicked submit my comment didn’t show up.

Grrrr… well I’m not writing all that over again. Regardless, just wanted to say great blog!

What’s Taking place i am new to this, I stumbled upon this I have

found It absolutely useful and it has helped me out loads. I am hoping to give a contribution & assist other

users like its helped me. Good job.

great points altogether, you simply gained a logo new reader.

What could you recommend in regards to your submit that you simply made

a few days in the past? Any sure?

Hi there! This post couldn’t be written much better!

Looking through this post reminds me of my previous roommate!

He continually kept preaching about this. I will forward this post

to him. Fairly certain he will have a good read.

I appreciate you for sharing!

It’s enormous that you are getting ideas from this post as well as from our discussion made at this time.

This article presents clear idea for the new visitors of blogging, that really how to do running a blog.

Admiring the dedication you put into your blog and in depth information you present.

It’s great to come across a blog every once in a while that isn’t the

same unwanted rehashed information. Wonderful read!

I’ve saved your site and I’m adding your RSS feeds to my

Google account.

Hey there! I know this is kind of off topic but I was wondering if you knew where I could

get a captcha plugin for my comment form? I’m using the same blog platform as

yours and I’m having difficulty finding one? Thanks a lot!

Hey there, I think your site might be having browser compatibility issues.

When I look at your blog in Chrome, it looks fine but when opening in Internet Explorer, it has some

overlapping. I just wanted to give you a quick heads up! Other then that,

fantastic blog!

Why people still make use of to read news papers when in this technological world the whole

thing is available on net?

At this time I am going away to do my breakfast, later than having my breakfast

coming yet again to read more news.

Hi there! This article could not be written much better!

Looking through this article reminds me of my previous

roommate! He constantly kept preaching about this.

I most certainly will forward this article to him.

Pretty sure he will have a very good read.

Thanks for sharing!

Pretty section of content. I just stumbled upon your weblog and in accession capital to

assert that I acquire in fact enjoyed account your blog posts.

Anyway I will be subscribing to your augment and even I achievement you access

consistently quickly.

Very nice post. I just stumbled upon your weblog and wanted to mention that I have truly

enjoyed surfing around your weblog posts.

In any case I’ll be subscribing for your rss feed and I am hoping you write again very soon!

Hello there! This is kind of off topic but I need some help from an established blog.

Is it very difficult to set up your own blog?

I’m not very techincal but I can figure things out pretty fast.

I’m thinking about setting up my own but I’m not sure where to begin. Do you

have any ideas or suggestions? Thank you

Oh my goodness! Amazing article dude! Many thanks, However I am having difficulties with your RSS.

I don’t understand why I can’t join it. Is there anyone else getting similar

RSS problems? Anybody who knows the answer can you kindly respond?

Thanx!!

Thanks for the auspicious writeup. It in fact used

to be a leisure account it. Look complicated to far introduced

agreeable from you! By the way, how could we be in contact?

Hi there to all for the reason that I am genuinely keen of reading this website’s post to be updated on a regular basis. It carries pleasant stuff.

Very nice blog post. I definitely love this site. Stick with it!

This is my first time pay a quick visit at here and i am really happy to read everthing at one place

I do not even understand how I ended up here but I assumed this publish used to be great

468698 29127I love the appear of your web site. I lately built mine and I was looking for some suggestions for my web site and you gave me some. May I ask you whether you developed the internet site by youself? 957233

Amazed, I’ve reached this milestone with this fascinating story, hats off to the author!

Enthralled, I’ve made it to this point with this absorbing story, a huge thank you to the author!